The Most Effective Ways to Budget for Financial Goals

Budgeting is a cornerstone of financial success, enabling individuals to achieve their goals, whether saving for a home, paying off debt, or building an emergency fund.

This article explores the most effective strategies for creating and maintaining a budget tailored to your financial aspirations.

1. Clarify Your Financial Goals

The first step in effective budgeting is defining your financial objectives. Whether you aim to save for retirement, pay off student loans, or fund a vacation, having clear and measurable goals provides direction and motivation. Break down larger goals into smaller milestones with specific timelines. For example, if you need $50,000 for a down payment on a house within five years, calculate how much you need to save monthly for 60 months, and adjust your budget accordingly.

2. Choose the Right Budgeting Method

Selecting a budgeting method that aligns with your lifestyle and goals is crucial. Here are some popular approaches:

The Pay-Yourself-First Method: Prioritize savings and debt repayment by setting aside a fixed amount from each paycheck before addressing other expenses. This method is ideal for individuals struggling to save consistently.

The Envelope System: Allocate cash into envelopes labeled for specific spending categories (e.g., groceries, entertainment). Once an envelope is empty, spending in that category stops until the next budgeting cycle. This system promotes discipline but may not suit those who prefer digital payments.

The 50/30/20 Rule: Divide your after-tax income into three categories: 50% for needs (e.g., housing, utilities), 30% for wants (e.g., dining out), and 20% for savings and debt repayment. This method is simple and flexible but may need adjustments for individuals with high debt or ambitious savings goals.

3. Track Your Income and Expenses

Understanding your cash flow is essential for creating a realistic budget. Start by calculating your after-tax income, including salary, side gigs, and other sources of revenue. Then, track all expenses—fixed (e.g., rent) and variable (e.g., dining out). Budgeting apps or spreadsheets can simplify this process.

4. Automate Savings

Automation ensures consistency in saving money toward your goals. Set up automatic transfers to savings accounts or investment funds on payday. This "out of sight, out of mind" approach reduces the temptation to spend discretionary income while building wealth over time.

5. Prioritize Spending Habits

Once you've tracked your expenses, identify areas where you can cut back without sacrificing quality of life. For instance:

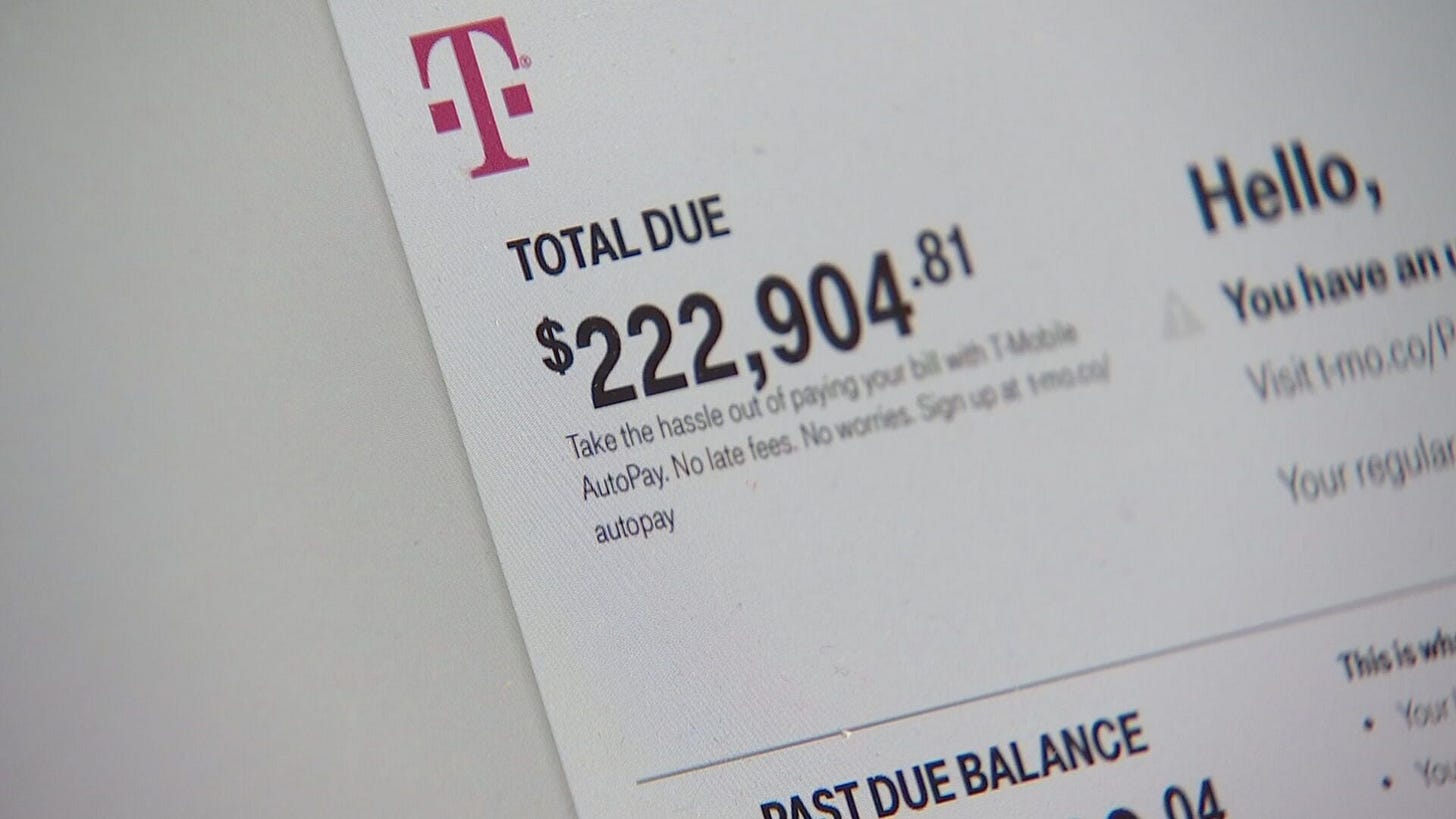

Switch to a cheaper phone plan. MVNO (Mobile Virtual Network Operators) carriers like Mint or Xfinity Mobile can cut your phone bill in half for the same service.

Reduce dining-out costs by cooking at home.

Cancel unused subscriptions.

Reallocate these savings toward your financial priorities, such as paying off high-interest debt or increasing contributions to retirement accounts.

6. Build an Emergency Fund

An emergency fund acts as a financial safety net, preventing you from derailing long-term goals due to unexpected expenses like medical bills or car repairs. Aim to save three to six months' worth of living expenses in a separate account.

High Yield Savings Accounts (HYSA) are great for this. They’ll build about 4-5% in interest monthly and the funds are easily accessible. Accounts like Marcus or Ally are great options.

7. Review and Adjust Your Budget Regularly

Life circumstances change—income increases, expenses fluctuate, and new goals emerge—so revisit your budget monthly or whenever significant changes occur. If the current system isn’t working, don’t hesitate to try another approach.

8. Celebrate Milestones

Reward yourself when you reach financial milestones. For example:

Say you have a savings goal of $5,000. Treat yourself to a spa day after hitting the target!

Enjoy a small splurge once you've paid off a credit card balance and closed the account.

These incentives keep you motivated and make budgeting feel less restrictive.

9. Avoid Debt Whenever Possible

Debt can hinder progress toward financial goals. Avoid taking on unnecessary debt by living within your means and prioritizing debt repayment in your budget.

10. Leverage Budgeting Tools

Budgeting apps can simplify tracking expenses and visualizing progress toward goals. Many apps allow customization based on individual needs while providing alerts for overspending or missed savings targets.

My personal pick: the EveryDollar App.

It links to your bank and tracks transactions in real time. Plus, you can easily copy and paste your budget template over month to month to make the process even quicker. Just make a few tweaks here and there for any planned changes and you’re set.

Check out these 5 easy steps to building your budget using the Everydollar App to get the (snow)ball rolling.

Case Study: Success Through Effective Budgeting

Consider the story of one woman who achieved her financial goals through disciplined budgeting:

She started by tracking her income and expenses monthly.

To save more aggressively, she reduced everyday costs like groceries and utilities.

She boosted her income through freelance work.

By setting short-term incentives (e.g., spa days), she stayed motivated during challenging periods.

After five years of consistent budgeting, she was debt-free with enough savings for a house down payment and investments yielding impressive returns.

Her journey underscores the importance of goal clarity, persistence, and adaptability in achieving financial success.1

Conclusion

Budgeting is not just about restricting spending—it’s about empowering yourself to achieve financial freedom and security. By clarifying goals, choosing the right method, automating savings, tracking progress, and celebrating achievements along the way, anyone can turn their aspirations into reality.

Start today by creating a budget tailored to your unique needs and watch as you move closer to achieving your dreams!

Check Out My Website

for Fitness and Finance Coaching

Citations:

https://fastercapital.com/content/Case-study--How-One-Woman-Achieved-Her-Financial-Goals.html