The Debt Snowball Method: A Simple Tool to Become Debt-Free

Building wealth isn't easy, but it is simple. It all starts with paying off debt. Here's how the debt snowball method will help you achieve financial freedom.

When you're buried under a mountain of debt, it can feel overwhelming to even know where to start. Credit card balances, student loans, personal loans—each debt with its own interest rate, due date, and minimum payment can make financial freedom seem out of reach. However, there's a debt repayment strategy that has helped countless people regain control of their finances: the debt snowball method.

The debt snowball method is a simple and effective approach to getting out of debt. It focuses on eliminating your smallest debts first, then gradually working your way up to larger debts. This method isn’t just about paying down debt—it’s about building momentum and motivation along the way. Let’s dive deeper into how it works, why it’s so effective, and what studies show about its success in helping people become debt-free.

What is the Debt Snowball Method?

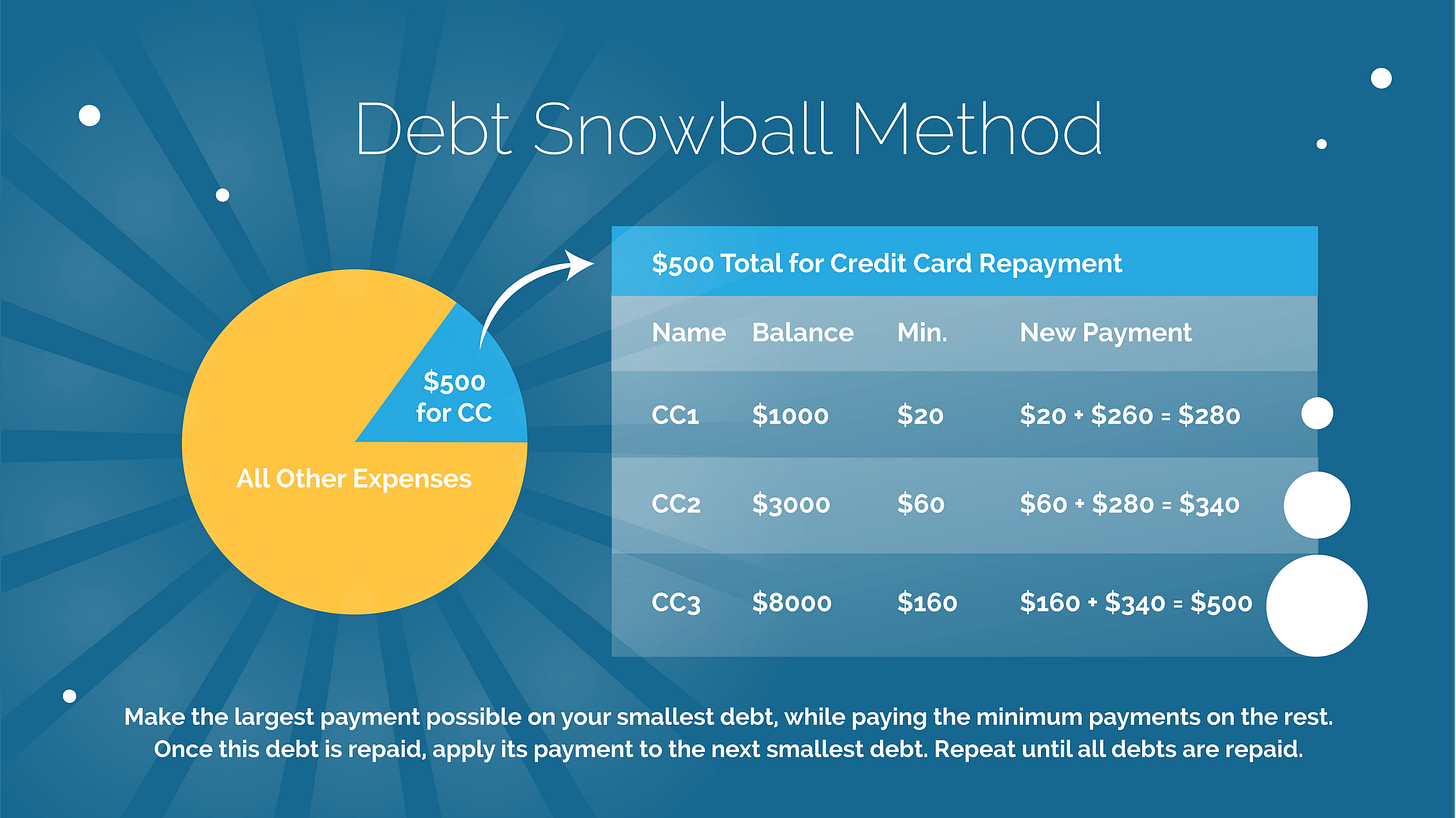

The debt snowball method involves organizing your debts from the smallest to the largest balance, regardless of the interest rate. You start by focusing all your extra money on paying off the smallest debt, while continuing to make minimum payments on the others. Once the smallest debt is paid off, you take the money you were paying toward it and apply it to the next smallest debt. This creates a snowball effect, where your payments grow larger and faster as you knock out each debt, building momentum toward full debt freedom.

Here’s a quick breakdown of the steps involved in the debt snowball method:

List your debts: Make a list of all your debts, starting with the smallest balance first.

Pay minimums on all debts: Make the minimum payments on each debt except the smallest one.

Focus on the smallest debt: Put all extra money you can afford toward paying off the smallest debt.

Eliminate the smallest debt: Once the smallest debt is paid off, move to the next smallest debt, adding the amount you were paying on the previous debt to the next one.

Repeat the process: Continue this cycle until all debts are paid off.

Why is the Debt Snowball Method So Effective?

While the debt snowball method might not be the most mathematically efficient approach to paying off debt (compared to methods like the debt avalanche), it has proven to be one of the most effective tools for many people. Let’s explore why this is the case:

1. Psychological Boost and Motivation

One of the most significant benefits of the debt snowball method is the psychological impact it has on those using it. Paying off small debts quickly provides a sense of accomplishment, which fuels your motivation to keep going. As you eliminate each debt, you can see and feel the progress, which helps to sustain your focus and keep you committed to the long-term goal of being debt-free.

This approach taps into the power of “small wins.” When you’re facing a large amount of debt, it can be discouraging to see little progress. But knocking out a small debt in a few months is rewarding, and it keeps you on track. This cycle of success is crucial when it comes to overcoming the emotional challenges of paying off debt.

2. Simplicity and Focus

The debt snowball method is simple and straightforward. With no complex calculations or strategies to remember, it’s easy to stick to. You don’t have to worry about interest rates or which debt has the highest rate—just focus on the smallest balance and build momentum from there.

For many people, this simplicity is key. Dealing with debt can be overwhelming, but the snowball method provides a clear, actionable path. When everything feels complicated, the simplicity of focusing on one debt at a time can feel like a relief.

3. Increased Cash Flow as Debts are Paid Off

As you pay off your smaller debts, the money that was previously going toward those payments becomes available to apply to the next debt. This increases your cash flow, allowing you to accelerate your payments. Once you’ve paid off a few small debts, the amount of money you can put toward the larger debts grows, creating a snowball effect that speeds up your progress.

This principle of "increased cash flow" helps break the debt cycle. As your debt balances go down, your monthly payments on individual debts get smaller, and you can put more money toward the next debt in line. It also makes paying off larger debts seem more manageable because you’re not starting from scratch each time.

4. Building Financial Discipline

By focusing on paying off one debt at a time, the debt snowball method helps people develop discipline and better financial habits. People learn how to budget, manage expenses, and prioritize their debt repayment. This discipline becomes invaluable as you move through the process, especially when the going gets tough.

Studies and Success Stories of the Debt Snowball Method

Several studies and success stories demonstrate the power of the debt snowball method in helping people achieve financial freedom. While exact statistics are difficult to pinpoint, there are many anecdotal and research-backed examples of its effectiveness.

One well-known advocate for the debt snowball method is financial expert Dave Ramsey. Through his program, Financial Peace University, Ramsey has helped thousands of individuals and families get out of debt using the debt snowball approach. According to his data, the average person who follows the Ramsey plan pays off over $5,000 in debt within the first year. This success rate is largely attributed to the motivation and momentum that the snowball method provides.

In a study conducted by the National Endowment for Financial Education (NEFE), it was found that people who used structured debt repayment strategies, such as the debt snowball method, were more likely to see success in getting out of debt compared to those who didn’t have a plan. The study highlighted that paying off small debts first created an emotional boost that made it easier to tackle larger debts.

Additionally, real-life success stories from Financial Peace University participants demonstrate how the debt snowball method can work in practice. For example, individuals like Ruthie, who paid off $60,000 in debt using the debt snowball approach, often cite the method’s ability to help them stay motivated through small victories. Ruthie shared that her quick wins helped her keep moving forward, even when the larger debts felt daunting.

Is the Debt Snowball Method Right for You?

The debt snowball method isn’t for everyone. If you’re someone who is highly motivated by minimizing interest payments, the debt avalanche method, which targets the highest interest rate debt first, may be a better fit. However, if you need a system that helps you build confidence, motivation, and discipline while paying off debt, the debt snowball method could be your ticket to financial freedom.

Ultimately, the key is finding the approach that works best for your personality and financial situation. No matter which method you choose, the most important thing is to create a plan and stick to it.

Conclusion

The debt snowball method is a simple, effective, and psychologically rewarding way to pay off debt. By focusing on the smallest debts first and building momentum, individuals can achieve financial freedom and gain control over their financial futures. While it may not be the fastest method in terms of minimizing interest, the emotional and motivational benefits it offers make it a powerful tool for many people on their journey to becoming debt-free. Whether you're paying off a few hundred dollars or tens of thousands, the debt snowball method provides a clear, manageable path to success.

Check Out My Website

for Fitness and Finance Coaching